Renters insurance is a crucial safeguard for your belongings and financial well-being, yet it’s often overlooked. Many renters mistakenly believe their landlord’s insurance covers their personal possessions, which is rarely the case. This affordable insurance protects you from a variety of risks, including theft, fire, vandalism, and certain types of water damage. Understanding the benefits of renters insurance and the coverage it provides can empower you to make informed decisions about protecting your valuables and yourself from potential financial hardship.

This article will delve into the specifics of renters insurance policies, outlining the types of coverage available, explaining how much renters insurance costs, and guiding you through the process of choosing the right policy for your individual needs. We will also address common misconceptions about renters insurance and highlight the compelling reasons why securing this essential protection is a wise investment for any renter. From understanding liability coverage to navigating the claims process, this guide will equip you with the knowledge you need to make informed decisions about your renters insurance coverage.

What Is Renters Insurance?

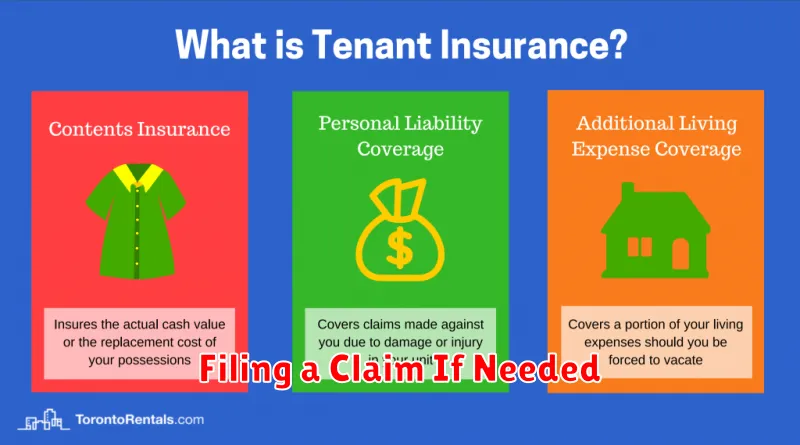

Renters insurance is a type of property insurance that provides coverage for a policyholder’s belongings and liability inside a rented dwelling. It does not cover the structure itself; that is the landlord’s responsibility. Instead, it protects the renter’s personal possessions against covered perils, such as fire, theft, and vandalism.

Renters insurance also provides liability protection. This coverage protects you if someone is injured in your rented home and you are found legally responsible. It can help cover their medical expenses and legal fees. Additionally, renters insurance often includes additional living expense (ALE) coverage, which can help pay for temporary housing if your rented home becomes uninhabitable due to a covered event.

What Does It Cover?

Renters insurance typically covers three main areas: personal possessions, liability protection, and additional living expenses.

Personal Possessions

This coverage protects your belongings from covered perils such as fire, theft, vandalism, and certain types of water damage. It can help replace items like furniture, electronics, clothing, and jewelry. Policies often offer either replacement cost coverage (the cost to buy a new item) or actual cash value coverage (the depreciated value of the item).

Liability Protection

If someone is injured in your apartment and you are found liable, liability coverage can help pay for their medical expenses and legal fees. It also covers damage you accidentally cause to other people’s property.

Additional Living Expenses

If your apartment becomes uninhabitable due to a covered event, this coverage can help pay for temporary housing, meals, and other related expenses while repairs are made.

Is It Required by Law?

While renters insurance isn’t mandated by federal law, many landlords are now making it a requirement for their tenants. This shift is due to increased awareness of liability and property risks.

Even if your landlord doesn’t require it, renters insurance is strongly recommended. It provides crucial financial protection for your belongings and liability coverage in case of accidents. Without it, you could face significant out-of-pocket expenses if your possessions are damaged or stolen, or if someone is injured in your rental unit.

Check your lease agreement to determine if renters insurance is mandatory for your specific situation. Even if it isn’t, consider the valuable protection it offers for a relatively small cost. It’s a worthwhile investment for peace of mind.

How to Choose a Policy

Choosing the right renters insurance policy requires careful consideration of your individual needs and budget. Coverage amounts are a crucial factor. Determine the replacement value of your belongings. Don’t underestimate this value, as underinsuring can leave you financially vulnerable in case of a loss.

Consider the types of perils covered. Standard policies typically cover events like fire, theft, and vandalism. You might need additional coverage for specific risks, such as flood or earthquake damage, which are often excluded from standard policies. Deductibles also play a role. A higher deductible lowers your premium but increases your out-of-pocket expenses in the event of a claim.

Liability coverage is another essential component. This protects you financially if someone is injured in your rented space and holds you liable. Finally, consider any additional coverage options like identity theft protection or coverage for valuable items like jewelry or electronics. Comparing quotes from different insurers is highly recommended to find the best balance of coverage and cost.

Filing a Claim If Needed

While we hope you never need to use your renters insurance, understanding the claims process is crucial. If you experience a covered event, such as a fire, theft, or vandalism, you’ll need to file a claim with your insurance company as soon as possible.

The process typically involves contacting your insurer, providing details of the incident, and documenting the damage or loss. This often includes a detailed inventory of damaged or stolen items, along with any supporting documentation like receipts or photographs. Your insurance company may also send an adjuster to assess the damage.

Be prepared to answer questions about the incident and provide any requested documentation. Accurate and thorough documentation is vital for a smooth claims process. Keep in mind that your policy will outline specific procedures for filing a claim, so it’s important to review your policy details.