Applying for a rental property can be a stressful experience, especially when facing a rental application denial. Discovering your application has been rejected can be disheartening, but it’s important to understand that it’s not the end of your housing search. This article provides valuable guidance on what steps to take after a rental application denial. We’ll cover everything from understanding the reasons for denial to disputing errors on your application, learning how to improve your application for future rentals, and knowing your tenant rights. Whether you’re dealing with a denied apartment application or a rejected rental house application, understanding the process can empower you to take the right steps forward.

A rental denial can occur for several reasons, ranging from a poor credit history to insufficient income. It’s crucial to determine the specific reason for the denial so you can take effective action. This article will outline the most common reasons for application denials and provide actionable strategies for addressing them. You’ll learn how to review your credit report, address negative credit entries, demonstrate your income stability, and prepare a stronger application. Don’t let a rental application denial discourage you; with the right approach, you can find the right rental property for you.

Understand the Reason for Denial

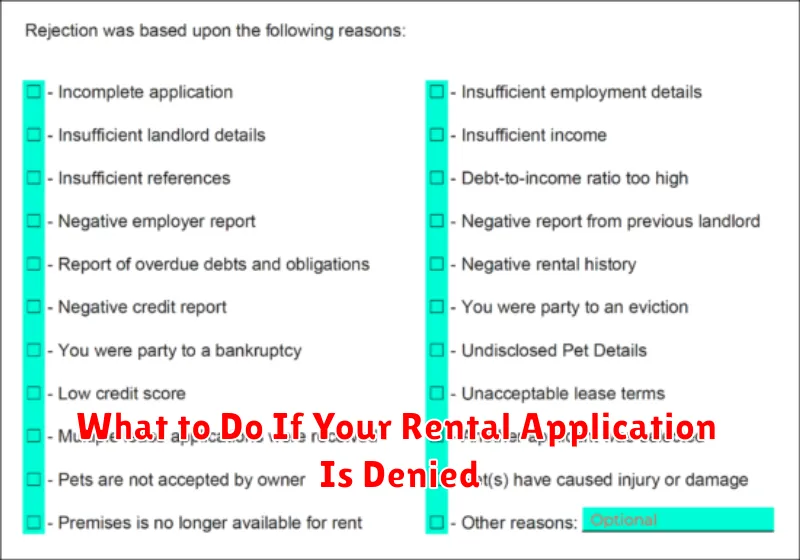

A rental application denial can be frustrating, but understanding the reason is the first step towards a successful future application. Landlords are required to provide you with the reason for denial, though specific laws vary by state. Don’t hesitate to ask directly if the reason isn’t immediately clear.

Common reasons for denial include a poor credit history, insufficient income, a negative rental history (including evictions), or incomplete application materials. Sometimes, the property may simply have been rented to another applicant.

Once you understand the reason for the denial, you can take steps to address it. This may involve improving your credit score, seeking a co-signer, providing additional documentation, or simply applying for properties more aligned with your current financial and rental history.

Check Your Credit Report

A primary reason for rental application denial is a poor credit history. Carefully review your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion). Look for any inaccuracies, errors, or negative marks that might be impacting your score.

Common issues include late payments, high credit utilization, collections accounts, and bankruptcies. Identifying these issues is the first step towards addressing them and improving your creditworthiness for future applications.

If you discover any errors, dispute them immediately with the respective credit bureau. Provide supporting documentation to validate your claim. Correcting errors can positively impact your credit score and improve your chances of rental approval.

Ask the Landlord for Feedback

While not legally required to provide a reason for denial, many landlords are willing to offer feedback. This can be invaluable in strengthening your future applications. Politely requesting feedback demonstrates your proactive approach to securing housing.

Key questions to consider asking include:

- Were there specific aspects of my application that led to the denial?

- Is there anything I can improve on for future applications?

- Was there a more competitive applicant, and if so, what differentiated them?

Be prepared for the possibility that the landlord may not offer detailed feedback. However, even a general understanding of the reason for denial can be helpful. Remember to maintain a respectful tone throughout the communication, even if you’re disappointed with the outcome.

Improve Your Application Materials

If your rental application was denied, take the opportunity to strengthen your application materials for future submissions. Carefully review the reasons for the denial provided by the landlord or property manager. This feedback is invaluable in guiding your improvement efforts.

Credit Report: If your credit score was a factor, obtain a copy of your credit report to identify any inaccuracies or areas for improvement. Dispute errors and consider strategies to improve your credit standing, such as paying down debt or addressing past due accounts. A higher credit score can significantly enhance your application’s appeal.

Income Verification: Ensure your income documentation is clear, complete, and accurately reflects your current financial situation. Provide pay stubs, tax returns, or other acceptable proof of income. A strong income-to-rent ratio demonstrates your ability to comfortably afford the monthly rent.

References: Provide strong references from previous landlords or employers who can attest to your reliability and responsible tenancy. Ensure your references are readily available and prepared to speak positively on your behalf.

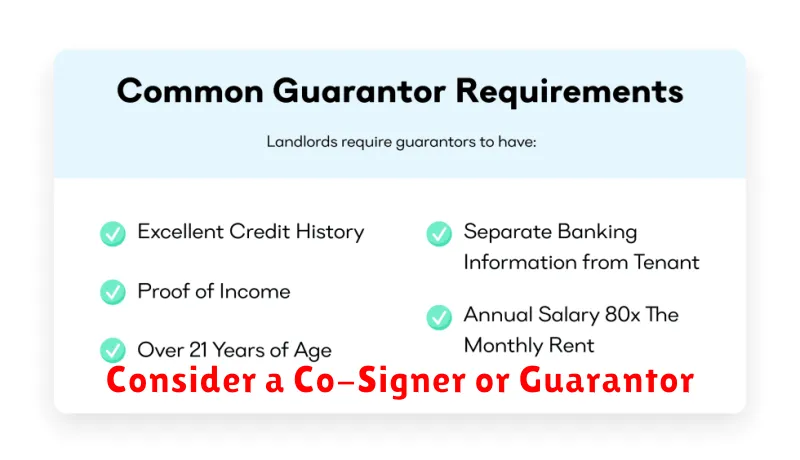

Consider a Co-Signer or Guarantor

If your application was denied due to insufficient credit or income, a co-signer or guarantor can strengthen your application. A co-signer assumes joint responsibility for the lease, meaning they are equally obligated to pay rent and adhere to the lease terms. A guarantor, on the other hand, agrees to pay the rent if you fail to do so, but isn’t directly responsible for the lease terms.

Finding a co-signer or guarantor requires open communication and trust. Clearly explain the responsibilities involved to potential candidates. Ensure they understand the financial and legal implications before they agree. Having a co-signer or guarantor can significantly increase your chances of approval for a rental property.