Navigating the rental market can be challenging, especially for first-time renters or those with limited credit history. Often, landlords require a co-signer or guarantor to mitigate risk. Understanding the roles and responsibilities of both is crucial for both the renter and the individual agreeing to take on this responsibility. This article will explore the intricacies of co-signing and acting as a guarantor for a rental agreement, clarifying the distinctions between the two and outlining the potential legal and financial ramifications involved.

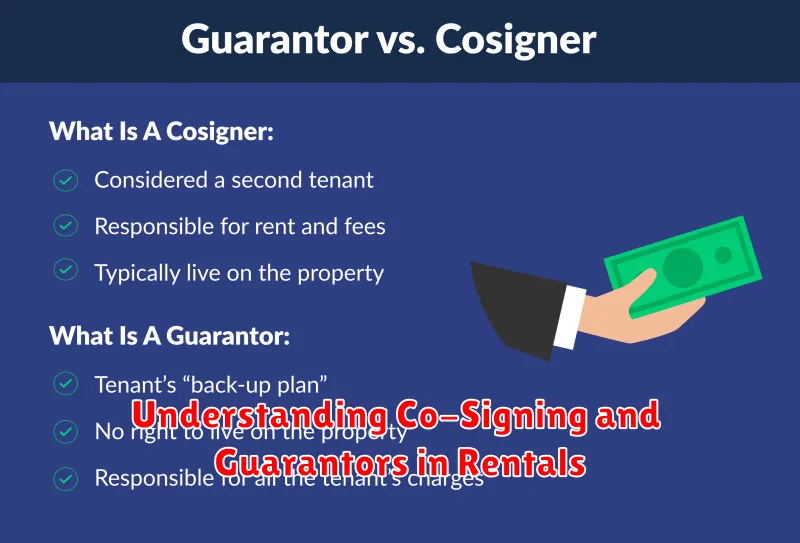

Co-signing and having a guarantor are common practices in rental agreements. A co-signer assumes equal responsibility for the lease, while a guarantor acts as a backup should the primary tenant default. This detailed explanation will help you understand the differences between a co-signer and a guarantor, allowing you to make informed decisions about rental agreements. We’ll cover topics including liability for rent payments, potential damage to the property, and the legal processes involved should issues arise.

What Is a Co-Signer?

A co-signer is an individual who agrees to take on the legal and financial responsibility of a lease alongside the primary tenant. They essentially “vouch” for the tenant, promising to make rent payments and fulfill other lease terms if the primary tenant fails to do so.

Co-signers undergo the same screening process as the tenant, including credit checks and background checks. This is because the landlord needs to be confident that the co-signer is financially capable of meeting the lease obligations.

Having a co-signer can be particularly helpful for individuals with limited credit history, low income, or other factors that might make it difficult to secure a rental on their own. The co-signer provides an added layer of security for the landlord, increasing the likelihood of application approval.

Why You Might Need One

Several situations may necessitate a co-signer or guarantor for a rental agreement. These individuals provide additional security for landlords, increasing the likelihood of rent payment and lease compliance. Landlords often require them when a prospective tenant presents a perceived risk.

Insufficient Credit History: A limited or poor credit history can raise concerns for landlords. A co-signer with established credit mitigates this risk. Low Income: If your income doesn’t meet the landlord’s requirements (typically a multiple of the monthly rent), a guarantor can assure them of your ability to pay.

First-Time Renters: Lacking a prior rental history can be a hurdle. A co-signer or guarantor vouches for your responsibility as a tenant. Self-Employed Individuals: Demonstrating consistent income can be challenging for self-employed individuals. A guarantor can provide additional financial assurance.

Students: Students often have limited credit and income history. A co-signer, often a parent or guardian, can help secure student housing.

Guarantor Responsibilities

A guarantor assumes significant financial and sometimes legal responsibility for a rental agreement. Their role is to provide assurance to the landlord that the rent will be paid and the terms of the lease will be upheld, even if the primary tenant is unable to fulfill their obligations.

The primary responsibility of a guarantor is to make rental payments if the tenant defaults. This includes any late fees or penalties incurred. They are also responsible for covering damages to the property beyond normal wear and tear, if the tenant is responsible and unable to pay.

Guarantors are legally bound by the lease agreement, meaning they can be pursued legally for any unpaid rent or damages. It’s crucial for potential guarantors to fully understand the terms of the lease before agreeing to this responsibility.

While the guarantor’s obligation is typically financial, in some cases, they may also be held responsible for ensuring the tenant adheres to the terms of the lease, such as quiet hours and pet restrictions. This depends on the specific language within the lease agreement.

Risks for Co-Signers

Co-signing a lease carries significant financial risks. It’s crucial to understand these risks before agreeing to become a co-signer.

Responsibility for Rent Payments: If the primary tenant fails to pay rent, the co-signer is legally obligated to cover the outstanding balance. This includes late fees and other associated charges.

Damage to the Property: Co-signers can also be held responsible for any damages to the rental property beyond normal wear and tear caused by the tenant.

Impact on Credit Score: Missed rent payments or other defaults by the primary tenant can negatively impact the co-signer’s credit score. This can affect their ability to secure loans, credit cards, or even other rental properties in the future.

Legal and Collection Actions: The landlord can pursue legal action against the co-signer to recover unpaid rent or damages. This can involve costly legal fees and potential damage to the co-signer’s credit report.

Limited Recourse: Co-signers often have little to no legal recourse against the tenant if they are forced to make payments on their behalf.

Legal Agreements and Protections

Co-signing and guaranteeing a lease involves entering into a legally binding contract. Understanding the terms and conditions within these agreements is crucial for both the tenant and the co-signer/guarantor.

The co-signer or guarantor typically signs the same lease agreement as the tenant, making them jointly and severally liable. This means they are equally responsible for fulfilling the terms of the lease, including rent payments and property maintenance.

Protections for co-signers/guarantors are limited. They should carefully review the lease agreement before signing. Some jurisdictions offer certain rights, but these vary widely. It’s recommended to seek legal counsel to understand the specific implications and potential risks in your location.

The agreement should clearly outline the responsibilities of all parties involved. It’s also important to clarify the duration of the co-signing/guarantor agreement, as it may extend beyond the initial lease term.