Creating a rental budget is a crucial first step in securing stable and affordable housing. A well-defined budget allows you to determine how much rent you can realistically afford, preventing financial strain and potential eviction. This guide will provide practical advice on how to create a rental budget that works for your individual circumstances, taking into account not just the monthly rent, but also additional expenses associated with renting. Learning how to budget for rent empowers you to make informed decisions, ensuring a comfortable and financially sound renting experience.

Developing a comprehensive rental budget involves more than simply calculating your income and subtracting your desired rent. It requires a thorough understanding of your overall expenses, including utilities, groceries, transportation, and other necessities. By carefully considering these factors, you can accurately determine your affordable rent range and avoid the pitfalls of overspending. This article will delve into the essential steps involved in creating a realistic and effective rental budget, offering valuable insights and practical tools to help you navigate the rental market with confidence and financial security. Successfully budgeting for an apartment will provide peace of mind and enable you to enjoy your rental experience without unnecessary financial stress.

Calculate Your Income and Expenses

Creating a realistic rental budget requires a clear understanding of your income and expenses. This involves carefully listing all sources of income and categorizing your expenses.

Start by calculating your total monthly income. This includes your salary, any additional income streams, and any potential rental income if you plan to rent out a portion of your property.

Next, itemize your monthly expenses. Divide these into two main categories: fixed and variable expenses.

Fixed Expenses

Fixed expenses remain the same each month. Common examples include:

- Rent

- Loan payments (e.g., student loans, car loans)

- Insurance premiums

Variable Expenses

Variable expenses fluctuate from month to month. These typically include:

- Groceries

- Utilities (e.g., electricity, water)

- Transportation

- Entertainment

Accurately tracking these expenses is crucial for developing a functional rental budget.

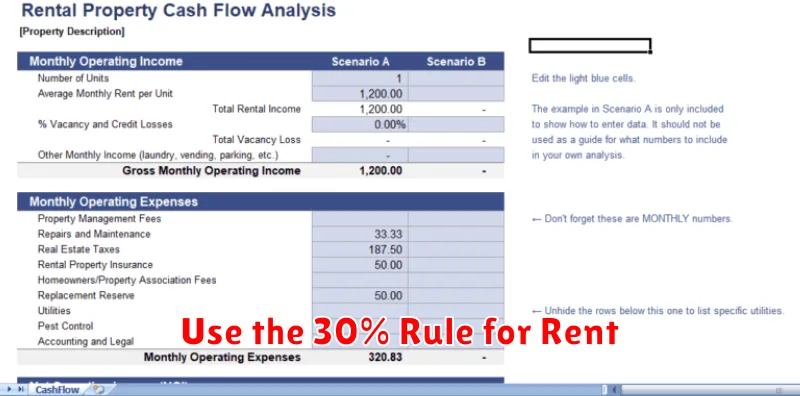

Use the 30% Rule for Rent

A common guideline for budgeting rent is the 30% rule. This rule suggests that you should spend no more than 30% of your gross monthly income on rent. This includes utilities if they are not included in your rent payment.

For example, if your gross monthly income is $4,000, you should aim to spend no more than $1,200 on rent (4,000 x 0.30 = 1,200). Sticking to this rule can help you avoid being rent-burdened, meaning you’re spending a disproportionate amount of your income on housing, which can make it difficult to afford other essential expenses.

While the 30% rule is a useful starting point, it’s important to consider your individual circumstances. Factors such as your location, debt, and savings goals can influence how much you can comfortably afford to spend on rent. If you have significant debt or are actively saving for a large purchase, you might want to aim for a lower percentage.

Factor in Utilities and Hidden Costs

Creating a realistic rental budget requires considering more than just the monthly rent. Utilities like electricity, water, gas, and internet can significantly impact your overall expenses. Research average utility costs in your target area to get an accurate estimate.

Beyond utilities, factor in hidden costs that can easily be overlooked. These might include renter’s insurance, parking fees, pet fees (if applicable), and maintenance costs not covered by your landlord. Consider also potential move-in expenses such as application fees, security deposits, and first and last month’s rent.

Creating a comprehensive list of these potential expenses ensures your budget accurately reflects the true cost of renting.

Set Aside an Emergency Fund

Unexpected expenses are a part of life, especially as a renter. A leaky faucet, a broken appliance, or sudden job loss can all throw off your carefully planned budget. An emergency fund acts as a buffer against these unforeseen events, preventing you from having to rely on high-interest credit cards or loans.

Aim to save at least three to six months’ worth of essential living expenses. This includes rent, utilities, groceries, and transportation. Start small if needed, even setting aside $50 or $100 a month will make a difference over time. Consider a separate high-yield savings account specifically for your emergency fund to encourage growth and prevent accidental spending.

Prioritize building this fund. It provides peace of mind and financial security, allowing you to handle emergencies without derailing your long-term financial goals.

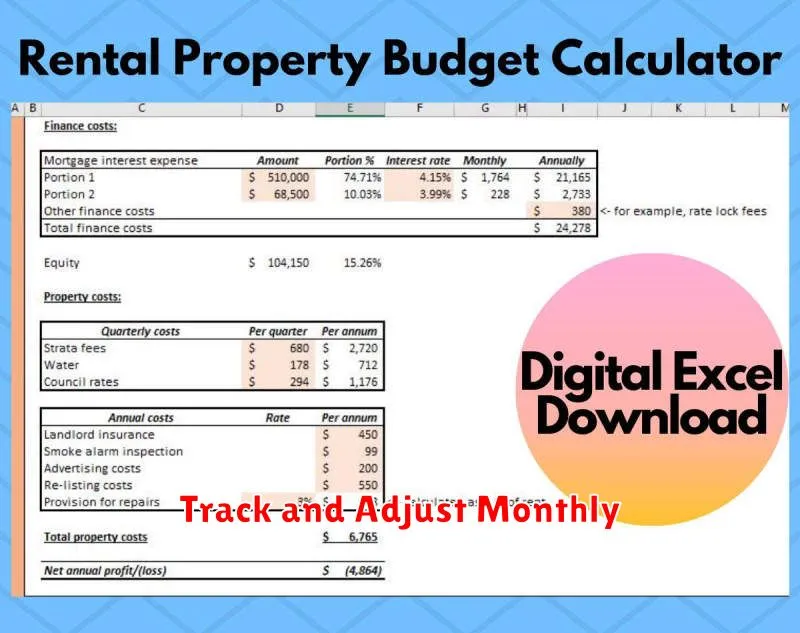

Track and Adjust Monthly

Creating a rental budget is not a “set it and forget it” task. Consistent tracking and monthly adjustments are crucial for its success. This allows you to identify areas of overspending and adapt to changing circumstances.

Use a spreadsheet, budgeting app, or even a notebook to monitor your actual spending against your budgeted amounts. Categorize your expenses (rent, utilities, groceries, etc.) for a clearer picture of your cash flow.

Compare your projected expenses to your actual expenses. Where are you over or under budget? Are there areas where you can reduce spending? Did unexpected expenses arise?

Based on your review, adjust your budget for the following month. Perhaps you need to allocate more funds to groceries and less to entertainment. The key is to remain flexible and adapt your budget to reflect your real-world spending habits.